Africa’s deposits of rare earth elements (REEs) and critical minerals such as cobalt, lithium, manganese, graphite, and nickel have placed the continent at the centre of a new global scramble. As major powers and multinational corporations race to secure these strategic resources for clean energy technologies, advanced electronics, and defence systems, Africa stands at a critical inflection point: to either remain a source of raw extractives or emerge as a global hub in the critical minerals value chain.

What is unfolding is not merely a commodities boom but a geopolitical shift, where the control of critical mineral supply chains is becoming a key determinant of national security, technological competitiveness, and climate transition strategies. African countries, particularly the Democratic Republic of Congo (cobalt), South Africa (manganese and platinum group metals), Zimbabwe (lithium), and Mozambique (graphite), are increasingly shaping discussions on the future of energy, mobility, and global manufacturing.

However, the historical pattern of extractive dependency, which is majorly marked by the export of unprocessed ores and the import of expensive finished goods, continues to cast a long shadow. Indeed, without deliberate policy, infrastructure, and institutional investments, Africa risks replicating the colonial model of resource extraction without development.

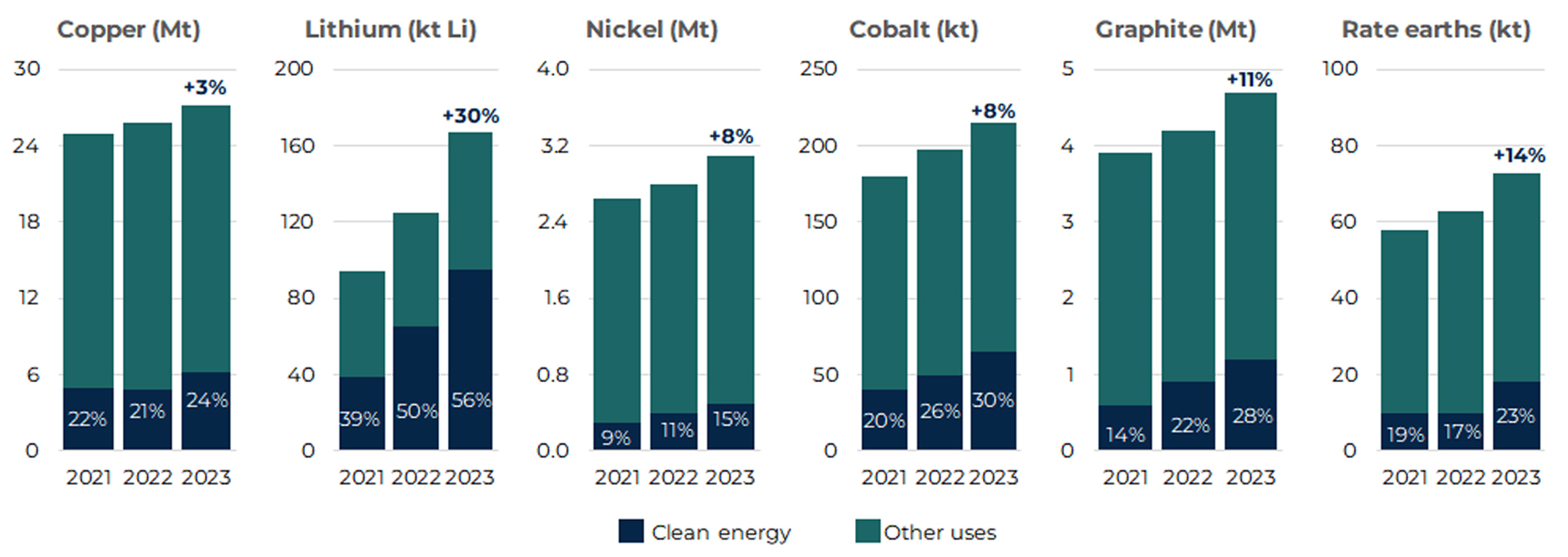

Critical minerals are indispensable to the global energy transition and the demand for minerals essential to green technologies have surged exponentially, as the world accelerates its shift toward net-zero carbon emissions.

(Source: IEA, Global Critical Minerals Outlook 2024)

Electric vehicles (EVs), wind turbines, and solar panels rely heavily on elements such as cobalt, lithium, graphite, manganese, and rare earth elements. These same minerals are equally indispensable in the production of semiconductors, AI chips, high-capacity batteries, and advanced military hardware. For instance, in the semiconductor industry, rare earths and specialty metals are useful in chip fabrication, which enable miniaturisation, heat resistance, and conductivity. Further, critical minerals are embedded in the supply chains of advanced military technologies as high-performance aircraft, missile guidance systems, radar installations, and night-vision equipment all rely on rare earths and other strategically important minerals for durability, precision, and electronic sensitivity.

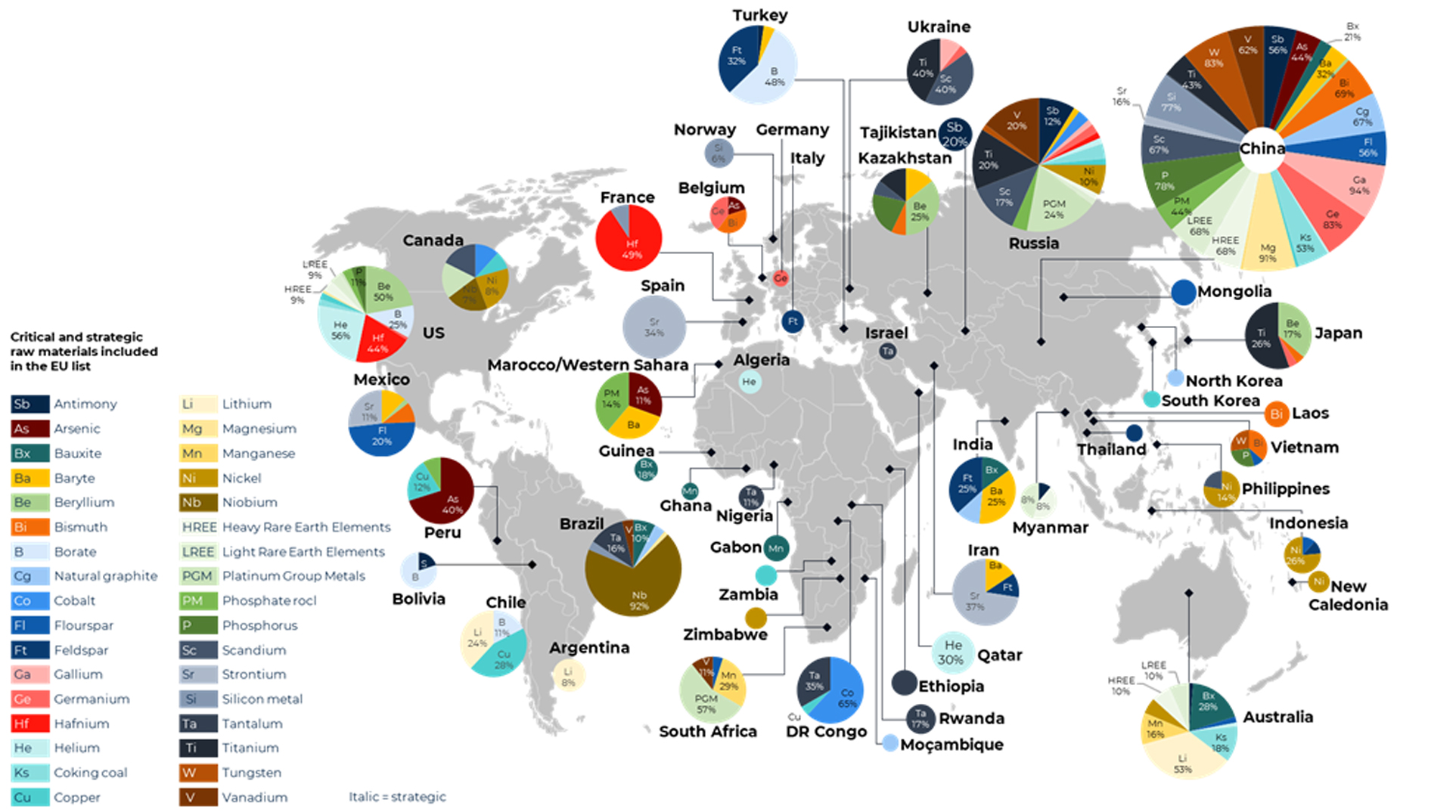

( SGU 2024. Carolina Liljenstolpe and Fredrik Karlsson Sources: SCREEN3/EU )

Amid this unprecedented global demand, Africa’s resource endowment has positioned the continent as a central player in the emerging geopolitical and economic landscape of critical minerals. For instance, the Democratic Republic of Congo (DRC) alone accounts for approximately 70% of global cobalt production while West Africa contributes around 30% of the world’s bauxite reserves. Southern and Eastern African countries such as Zimbabwe, Namibia, and Mali are also home to rapidly growing lithium reserves, attracting major investments from China, the EU, and multinational battery manufacturers. Rare earth elements, which are crucial for magnets in wind turbines and precision-guided missile systems, are found in large quantities in South Africa, Burundi, and Tanzania. Mozambique and Gabon also possess abundant deposits of graphite and manganese.

Despite its resource endowment, Africa continues to capture only a sliver of the global value chain, largely confined to the upstream segment. This model has consistently failed to generate transformative development outcomes across the continent. The danger today is clear: without proactive strategy and reform, Africa risks perpetuating a cycle of low-value participation, environmental degradation, and dependency on external markets for technological progress and economic diversification.

In its 2023 strategic report, the Africa Finance Corporation (AFC) advocated for a beneficiation-first approach, where African nations leverage their mineral wealth to catalyse local processing, manufacturing, and innovation ecosystems. This involves refining minerals locally, manufacturing components, and embedding these capabilities within broader industrial ecosystems. In this purview, beneficiation is not merely a technical process but a lever for technology transfer, workforce development, infrastructure spillovers and regional supply chain integration.

To create resilient and inclusive value chains, African governments and private sector stakeholders must take coordinated action. Four interlocking pillars are crucial to building competitive, resilient, and inclusive mineral value chains:

African nations must establish and harmonise beneficiation policies on a sub-regional and regional basis to galvanise value addition over raw exports. This means moving beyond aspirational rhetoric to implement mining codes that mandate local processing, encourage joint ventures, and embed Environmental, Social, and Governance (ESG) standards into licensing frameworks. For instance, Zimbabwe’s policy requiring lithium producers to develop local processing capacity before exporting has attracted interest from battery manufacturers and Chinese firms alike. Likewise, Botswana’s diamond beneficiation strategy, which mandated local sorting, cutting, and polishing, has helped the country retain more value and develop a skilled workforce.

Fiscal and tax incentives must also be refined to ensure traction in the implementation of beneficiation policies. Tax holidays, capital allowances, and infrastructure subsidies targeted at investors in downstream projects can crowd in private capital. Predictability and transparency in regulation are also essential to de-risk long-term industrial investments.

A competitive value chain cannot thrive without reliable transport and energy infrastructure. Mineral-rich zones across the DRC, Zambia, and Zimbabwe are often landlocked or poorly connected to ports, making logistics costly and inefficient. Strategic investments in port expansions (like Ghana’s Tema Port), rail links (such as the Lobito Corridor), and all-season roads are critical to unlocking value. Governments must also prioritise investment in renewables near mineral belts, using public-private partnerships to ensure energy access that is both cost-effective and climate-aligned.

The development of Special Economic Zones (SEZs) near mineral clusters offers a tested model for catalysing local industrial growth. These zones can significantly reduce barriers to entry for investors. Ethiopia’s Bole Lemi and Hawassa industrial parks have demonstrated how targeted SEZs can support export-oriented manufacturing.

Crucially, these zones must go beyond assembly to become technology hubs. African governments must incentivise research and development collaboration between universities, startups, and global technology partners in areas like battery storage, mineral separation, and circular economy solutions.

Africa’s mineral wealth is unevenly distributed, but regional integration under the AfCFTA offers a platform to turn this diversity into strength. Through coordinated policies and infrastructure planning, countries can create cross-border industrial clusters where upstream, midstream, and downstream segments are optimally located across member states. For example, a regional battery value chain could involve lithium extraction in Zimbabwe, cobalt from the DRC, component manufacturing in South Africa, and final assembly in Kenya or Mozambique To make this vision a reality, regional institutions such as the African Development Bank (AfDB, Afrexim Bank, Africa Finance corporation (AFC) and the Trade and Development Bank (TDB) must offer pooled financing, guarantee facilities, and corridor-specific infrastructure investments.

With global demand surging and governments increasingly prioritising local value addition, Africa’s critical minerals sector is ripe for private capital, innovation, and strategic partnerships. Emerging opportunities include:

Exploration-stage and brownfield mineral assets across Africa offer attractive returns for risk-tolerant investors. Countries such as Namibia (lithium), Zimbabwe (pegmatites), and Guinea (bauxite) are opening up to private capital, mining-focused venture capital, and development finance institutions seeking exposure to high-demand critical minerals. Investors can benefit from first-mover advantages, favourable geology, and the growing pool of bankable projects supported by geological mapping initiatives and sovereign guarantees.

African governments are increasingly open to strategic joint ventures (JVs) that combine global expertise with local legitimacy. Companies such as China’s CMOC Group (JV with Gécamines in DRC) and Australia’s AVZ Minerals (JV in Manono Lithium Project) exemplify how foreign capital can successfully partner with African state-owned enterprises and artisanal miners under transparent terms.

As host governments push for value addition, investors have a growing window to finance and operate refining and midstream facilities, such as lithium hydroxide plants, cobalt sulphate refineries, and manganese alloy smelters, close to extraction sites.

With supply security now a top geopolitical concern, especially for electric vehicle and battery producers, offtake agreements are a vital tool for locking in long-term access to critical minerals. Firms can negotiate multi-year contracts with African producers, guaranteeing supply in exchange for upfront capital, equity stake or technical support.

The rise of ESG-driven supply chains creates demand for technological solutions that enhance transparency, compliance, and efficiency. Private companies can deploy blockchain-based traceability systems, IoT devices for real-time environmental monitoring, and AI-powered geological surveys to help operators meet global sustainability standards.

Parsons is at the forefront of advising clients across the full value chain of Africa’s critical minerals sector, including structuring and financing mining and infrastructure joint ventures, advising on cross-border M&A, PPP frameworks, offtake agreements, supporting ESG due diligence, regulatory compliance, sustainable sourcing protocols, representing private equity, sovereign wealth, and development finance investors on mineral project sponsors.

Our multidisciplinary team combines deep sectoral expertise with local regulatory insight across jurisdictions including Nigeria, DRC, Burkina Faso, South Africa, Namibia, Zambia, Zimbabwe, and Mozambique.

Africa’s critical mineral wealth is its new oil. But unlike previous extractive booms, the continent now has the policy tools, investment frameworks, and regional ambition to lead a paradigm shift toward industrial value creation.

Private sector players who act boldly and collaboratively can unlock immense commercial and developmental returns. At Parsons, we stand ready to partner with you to unlock the next frontier of Africa’s energy and commercial revolution.

⚠️ Legal Disclaimer: This publication is intended for general informational purposes only and is not a substitute for professional legal advice. The information provided herein may not be applicable to your specific circumstances and should not be relied upon as legal counsel. For advice tailored to your situation, you should consult with qualified legal counsel.

📩 Contact us to discuss opportunities across Africa’s critical mineral markets at info@Parsons-legal.com.

Africa Policy Research Institute (APRI), ‘China's Role in Africa's Critical Minerals

Landscape: Challenges and Key Opportunities’ (2024) https://afripoli.org/chinas-role-in-africas-critical-minerals-landscape-challenges-and-key-opportunities

International Energy Agency (IEA), Global Critical Minerals Outlook 2024

https://www.iea.org/reports/global-critical-minerals-outlook-2024

International Energy Agency (IEA), The Role of Critical Minerals in Clean Energy Transitions (2021) https://www.iea.org/reports/the-role-of-critical-minerals-in-clean-energy-transitions

Kieran Whyte, ‘Ensuring the sustainable journey of Africa’s critical minerals’ Chambers Expert Focus (16 February 2024) https://chambers.com/legal-trends/sustainable-journey-of-africas-critical-minerals

World Bank, The Mineral Intensity of the Clean Energy Transition (2023)

https://documents.worldbank.org/en/publication/documents-reports/documentdetail/099052423172525564/p16627806f5aa400508f8c0bdcba0878a3e